Tax Credits for Your Energy Systems Turns into Yearly Savings

If you purchased equipment that made your Arkansas home more energy efficient, you may be entitled to a tax break. The IRS has two categories of tax credits for eligible energy-efficient products: the non-business energy property credit and the residential energy efficient property credit.

If you purchased equipment that made your Arkansas home more energy efficient, you may be entitled to a tax break. The IRS has two categories of tax credits for eligible energy-efficient products: the non-business energy property credit and the residential energy efficient property credit.

The non-business energy property tax credit allows you to claim qualified purchases made in 2012 or 2013. The IRS specifies different dollar amounts for different types of equipment. For example, an advanced main air circulating fan, which circulates warm air through your heating ducts, is worth $50, while an air source heat pump gets you $300 back. The credit also allows you to claim 10% of the cost of insulation, although installation fees aren’t included. The maximum amount you can get back is $500.

The residential energy efficient property tax credit equals 30 percent of the purchase price of such alternative energy equipment as solar products, a geothermal heat pump or residential wind turbine. In order to qualify, the equipment must be installed in your primary residence. No maximum dollar amounts apply to geothermal heat pumps or wind turbines. Tax credits for solar energy systems are capped at $500 per .5 kW of power capacity, according to Energy Star. The residential energy efficient property credit is in effect until 2016.

To claim the credits, you need IRS Form 5695. Although you don’t have to submit them, the IRS recommends that you keep your store receipts and the manufacturer’s certification statements attesting to the products’ eligibility.

Contact Paschal Heat, Air & Geothermal today to find out how we can help you choose the best equipment to increase your home’s energy efficiency.

Our goal is to help educate our customers in Springdale, Arkansas about energy and home comfort issues (specific to HVAC systems). For more information about tax credits and other HVAC topics, download our free Home Comfort Resource guide.

Image courtesy of Shutterstock

general Resources

general

How To Prepare Your Home for the Holidays & Extended Vacations

general

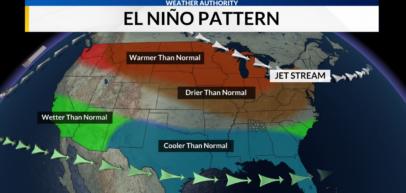

The El Niño Winter 2023: A Comprehensive Guide for Homeowners