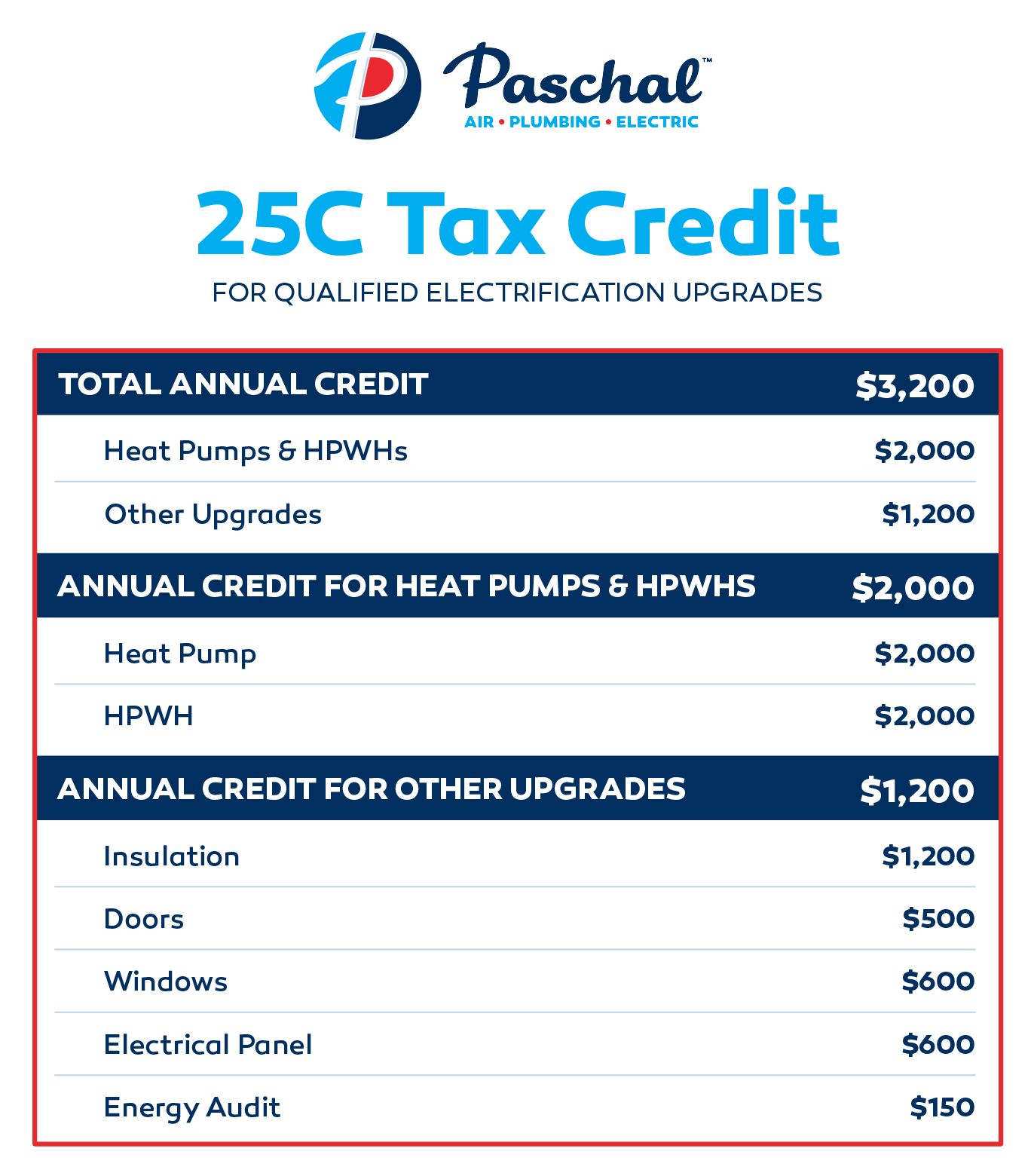

25C Residential Energy Efficiency Tax Credit

The 25C tax credit incentivizes electrification by lowering the total cost of qualified electrification upgrades.

Starting now until 2032, homeowners can benefit from federal income tax credits of up to $3,200 annually to help lower the cost of energy-efficient home upgrades by up to 30 percent. These upgrades include installing heat pumps, heat pump water heaters, insulation, doors and windows, electrical panel upgrades, home energy audits, and more. These upgrades are covered by the tax credits and can help families save money on their monthly energy bills for years to come.

For the first time, air source heat pumps for space heating/cooling and HPWHs will be eligible for a tax credit of up to $2,000 per year, and electrical panel upgrades installed in conjunction with a heat pump or HPWH will be eligible for a tax credit of up to $600.

Homeowners can also take advantage of the modified and extended Residential Clean Energy credit, which provides a 30 percent income tax credit for clean energy equipment such as rooftop solar, wind energy, geothermal heat pumps, and battery storage through 2032. This credit will step down to 22 percent for 2033 and 2034.

Commercial building owners can also take advantage of these new tax credits and deductions. The Inflation Reduction Act of 2022 extends and expands the energy-efficient commercial buildings deduction that was made permanent under Section 179D in 2021. Buildings that increase their energy efficiency by at least 25 percent will be able to claim this deduction, with bonuses for higher efficiency improvements.

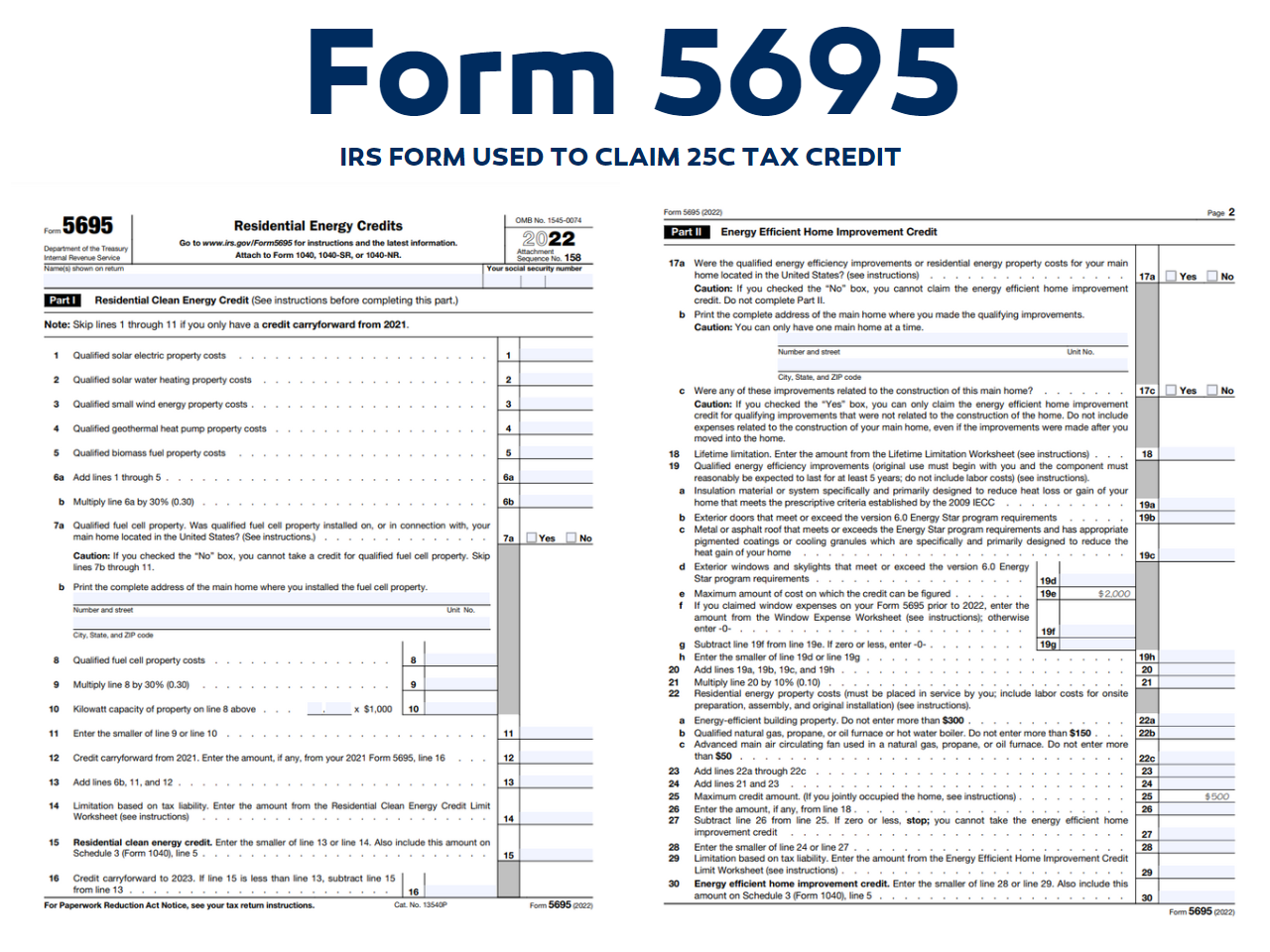

FAQ Courtesy of the Internal Revenue Service

What residential clean energy expenditures are eligible for the Residential Clean Energy Property Credit, and how much is the credit?

The following residential clean energy expenditures are eligible for a Residential Clean Energy Property Credit of 30% of the cost:

- solar electric property expenditures (solar panels);

- solar water heating property expenditures (solar water heaters);

- fuel cell property expenditures;

- small wind energy property expenditures (wind turbines);

- geothermal heat pump property expenditures; and

- battery storage technology expenditures.

Is there a dollar limit on the Residential Clean Energy Property Credit?

- No, there is no overall dollar limit for the Residential Clean Energy Property Credit. The credit is generally limited to 30% of qualified expenditures made for property placed in service beginning in 2022 through 2032. However, the credit allowed for fuel cell property expenditures is 30% of the expenditures up to a maximum credit of $500 for each half kilowatt of capacity of the qualified fuel cell property. In the case of a residence or dwelling unit that is jointly occupied by two or more individuals, the maximum amount of such fuel cell property expenditures used to calculate the total Residential Clean Energy Property Credit amount for all individuals living in that dwelling unit during a calendar year is limited to $1,667 for each half kilowatt of capacity of qualified fuel cell property.

May a taxpayer include labor costs when calculating the credits?

The rules vary by credit.

- When calculating the Energy Efficient Home Improvement Credit, a taxpayer may include the labor costs for the onsite preparation, assembly, or original installation of residential energy property such as central air conditioners; natural gas, propane, or oil water heaters; natural gas, propane, or oil furnaces or hot water boilers; electric or natural gas heat pumps; electric or natural gas heat pump water heaters; biomass stoves or biomass boilers; or improvements to panelboards, sub-panelboards, branch circuits, or feeders. In contrast, a taxpayer may not include the labor costs for qualified energy efficient building envelope components including a qualifying insulation material or system, exterior window, skylight, or exterior door. Thus, for an energy efficient building envelope component for which a taxpayer pays a fixed price, the taxpayer must make a reasonable allocation between the qualifying cost of the property and the nonqualifying labor cost of the installation.

- When calculating the Residential Clean Energy Property Credit, a taxpayer may include the labor costs properly allocable to the onsite preparation, assembly, or original installation of the qualified property and for piping or wiring to interconnect the qualifying property to the home.

May a taxpayer claim the credits in the year of purchase if installation of the qualifying property occurs in a later year?

- No. A taxpayer may not claim the credits until the year the property is installed.

Are there any requirements for how long the property must remain in use to qualify for the credits?

- In the case of building envelope components for which an Energy Efficient Home Improvement Credit is available (exterior doors, windows, skylights, insulation and air sealing materials or systems), the component must reasonably be expected to remain in use for at least 5 years. This requirement does not apply to other property discussed in these FAQs.

Is there a lifetime limit on the credits?

- No. There is no lifetime limit for either credit; the limits for the credits are determined on a yearly basis. For example, beginning in 2023, a taxpayer can claim the maximum Energy Efficient Home Improvement Credit allowed every year that eligible improvements are made.

May a taxpayer carry forward unused credits to another tax year?

The rules vary by credit.

- Under the Energy Efficient Home Improvement Credit: a taxpayer may not carry the credit forward. Thus, if a taxpayer does not have sufficient tax liability to claim all or a portion of the credit in the year in which the related property for which the qualifying expenditure is placed in service, the unused amount of the credit may never be claimed.

- Under the Residential Clean Energy Property Credit: a taxpayer may carry forward the unused amount of the credit to reduce tax liability in future tax years.

Will a taxpayer qualify for the credits if the property installed has been used by another individual?

- No. Used property is not eligible for the Energy Efficient Home Improvement Credit or the Residential Clean Energy Property Credit.

Are the credits refundable or nonrefundable?

- Both the Energy Efficient Home Improvement Credit and the Residential Clean Energy Property Credit are nonrefundable personal tax credits. A taxpayer claiming a nonrefundable credit can only use it to decrease or eliminate tax liability. A taxpayer will not receive a tax refund for any amount that exceeds the taxpayer’s tax liability for the year.

What are the requirements for a home energy audit to qualify for the Energy Efficient Home Improvement Credit?

- The audit must include an inspection of a dwelling, including condominiums and certain manufactured homes, located in the United States that is owned or used by the taxpayer as the taxpayer’s principal residence. The home energy auditor must provide a written report (to the taxpayer) that identifies the most significant and cost-effective energy efficiency improvements for that dwelling, including an estimate of the energy and cost savings for each such improvement. The auditor must meet the certification or other requirements specified by the Department of the Treasury and the Internal Revenue Service in forthcoming guidance.

general Resources

general

Why Home Warranty Companies May Not Be the Safety Net You Think

general

Paschal Air Plumbing & Electric acquires Patriot Heat & Air to expand services to Oklahoma