Want to save with Paschal? Don’t miss our current offers and specials

Want to save with Paschal? Don’t miss our current offers and specials

Return to Paschal Resource & Education Hub

Many United States Homeowners can get up to $14,000 to make energy efficient improvements to their homes. It might sound too good to be true, but it’s part of a historic legislation passed in August 2022 called the Inflation Reduction Act of 2022 . According to the White House, $14,000 is available in direct consumer rebates & tax incentives for families to buy heat pumps or other energy efficient home appliances, saving them at least $350+ per year. It also includes up-front discounts, generous rebates, tax incentives and low-cost financing available to homeowners who make energy efficient upgrades to their homes. IRA is projected to reduce total carbon emissions by around 40% by 2030, according to the White House.

There are two separate rebate programs through IRA to help homeowners swap out old power-sucking appliances with new energy-efficient upgrades.

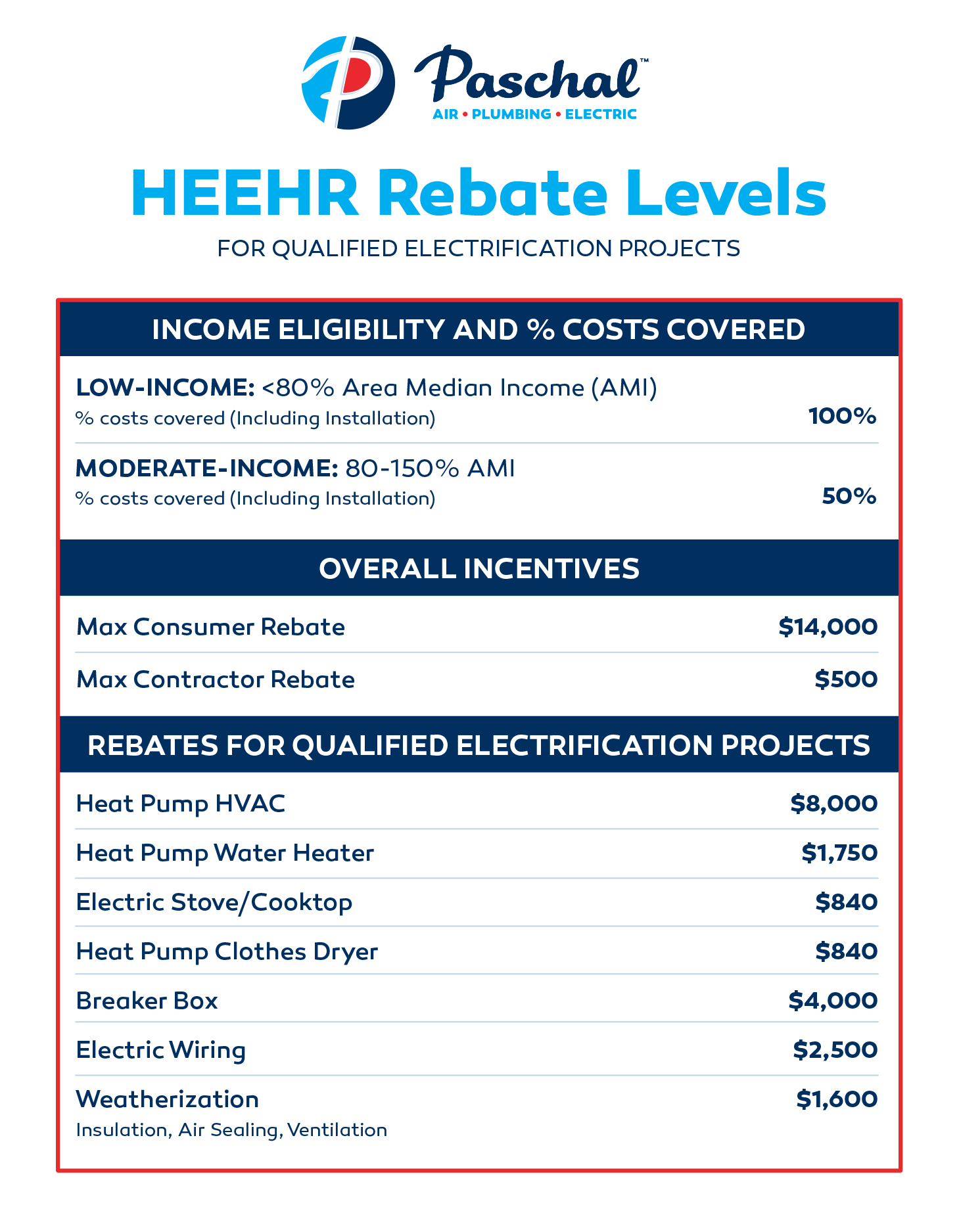

This rebate program is designed to help low- and middle-income homeowners save up to $14,000 on energy efficient upgrades. It covers up to 100% of electrification projects for low-income households and up to 50% for middle-income earners. HEEHRA covers the appliance, professional installation and labor costs.

This includes up to:

(Amount based on income category)

HEEHRA rebates are available point-of-sale, which means consumer rebates are applied at the time of purchase. HEEHRA was designed to give low- and moderate-income households the opportunity to save money up front. It also helps these same families save even more money on future utility bills.

HEEHRA is not available yet and will be distributed on a state-by-state basis.

This rebate program will provide homeowners more than $4 billion collectively to make homes more energy-efficient. The HOMES rebate program will give homeowners who cut energy usage by at least 35% rebates of up to $8,000 for low- and middle- income households and up to $4,000 for high-income households. HOMES specifically gives incentives to modeled (pre-upgrade) or measured (post-upgrade) energy savings for homeowners.

HOMES rebates can be maximized by pairing electrification and weatherization upgrades. This program isn’t up and running yet and it isn’t clear what parts will be retroactive. We do know the install has to be complete by September 30, 2031 to qualify.

Rebates Available through Paschal

(Amount based on income category)

Rebate Income Guide

Rebate amounts are based on area median income (AMI), which is calculated based on the midpoint of a region’s income distribution. Fannie Mae has a free online AMI tool to help calculate the AMI for your region.

As we mentioned, the IRA rebates and tax credits are not live just yet. It’s not clear when they will take effect. The HOMES rebates will be distributed at a state level, so the start date will be determined by where you live.

The Inflation Reduction Act states rebates will be available through September 30, 2031.

The answer is, it depends. HEEHRA can stack with federal energy efficiency and electrification tax credits, according to the IRA.

HEEHRA cannot be stacked with HOMES for the same single upgrade. Meaning, you can use HEEHRA for some upgrades and other federal grants or rebates for other upgrades. For example, you might use HEEHRA to upgrade your HVAC system and a different part of IRA for your water heater upgrade. Bottom line, HOMES and HEEHRA cannot be combined for the same upgrade, but households who qualify for both can use them on separate upgrades. Clarity on stacking rebates and tax credits through IRA is expected to be released soon.

Rebates are up-front savings, which means they are given to the customer at the time of sale. It’s up to the home services company to file paperwork.

Tax credits means money is given back to customers when they file their taxes. The IRA tax credits are an annual incentive, meaning homeowners can use every year up to $1,200 per year. Think of it this way, you can use the tax credit this year for a new heat pump heating and air system and next year you can upgrade your home with a new heat pump water heater.

While you are waiting for IRA to take effect you can start preparing now and prioritize your home improvements. Here are a few things to consider:

Paschal Air, Plumbing & Electric has Professional People ready to help with your energy-efficient upgrades. Call to talk to a Paschal Comfort Specialist today at 479-751-0195 or schedule online.

Stay Informed!

Enter your email address below to receive news and updates about the Inflation Reduction Act & how you can take advantage.

Oops! We could not locate your form.