Want to save with Paschal? Don’t miss our current offers and specials

Want to save with Paschal? Don’t miss our current offers and specials

Return to Paschal Resource & Education Hub

⚠️ 2025 Update: The One Big Beautiful Bill Act (OBBBA) passed in mid-2025 doubles Section 179 deduction limits and broadens eligible property. Businesses should review capital spending plans to maximize deductions for the 2025 tax year.

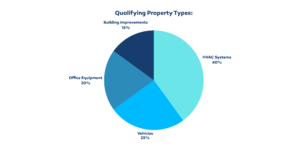

Section 179 is a tax rule that allows businesses to deduct the full cost of certain equipment and property in the year it’s placed into service.

✅ Instead of depreciating equipment over multiple years, Section 179 lets you write off the entire purchase price immediately.

Tip: Always consult a tax professional before claiming Section 179. This is educational information, not tax advice.

If you own a business or building, Section 179 can help you save big when you buy a new HVAC system. Instead of waiting years to write off the cost, you can deduct the whole thing this year. For example, if your new system costs $50,000, you can take $50,000 off your taxable income right away — which means you pay less in taxes.

The only downside is that your business needs to be making money to use the deduction, and there’s a limit on how much you can write off each year. But for most business owners, it’s an easy way to upgrade your heating and cooling and keep more money in your pocket.

Curious about how much you could save by upgrading your HVAC system under Section 179? Use Crest Capital’s free, easy-to-use calculator to see your potential first-year tax deduction. It takes just a couple of minutes and can help you plan your equipment purchases more effectively.

🔗 Try the Section 179 Calculator Now

This tool shows how much you can deduct based on your tax bracket, equipment cost, and bonus depreciation. It also helps you understand how Section 179 compares to traditional depreciation.

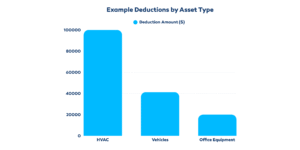

Short Answer: Yes — HVAC systems, heat pumps, geothermal systems, air conditioners, and furnaces all qualify for the full Section 179 deduction under current IRS guidelines.

If you own property, manage multiple units, or run a small business, this is one of the best ways to upgrade your heating and cooling systems while getting a major tax break. When you install a new, energy-efficient HVAC system, you can deduct the full purchase and installation cost—up to the annual Section 179 limit—for the year the system is placed in service.

HVAC systems weren’t always eligible for this deduction. The change came with the Tax Cuts and Jobs Act (TCJA) passed by Congress in 2017, which took effect January 1, 2018. Before that, HVAC upgrades were considered capital improvements—meaning you had to depreciate them slowly over many years. The TCJA reclassified HVAC systems as qualified property, making them eligible for immediate expense under Section 179.

That’s a big win for you as a property owner or business operator. It means you can:

And while this policy has been in place for several years, it’s always smart to check out the IRS Section 179 limits each tax year, since deduction of caps and bonus depreciation rules can change.

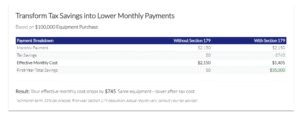

Scenario: You own a small business and install a new HVAC system costing $100,000.

Stacking with Bonus Depreciation: After applying Section 179 (up to $2,500,000 in 2025), any remaining eligible asset cost can be deducted using 100% bonus depreciation for assets placed in service after Jan 19, 2025.

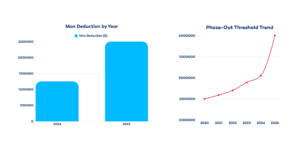

The IRS sets annual maximum deductions. Deductions start phasing out after a certain total amount of equipment is purchased.

| Year | Max Deduction | Phase-Out Starts | Bonus Depreciation | SUV Cap |

| 2024 | $1,220,000 | $3,050,000 | ~60–80% | $30,500 |

| 2025 | $2,500,000 | $4,000,000 | 100% | $31,300 |

In the years ahead, Section 179 will keep helping business owners deduct the cost of new equipment like HVAC systems. Because of recent laws like the One Big Beautiful Bill (OBBBA), the limits are higher than ever, which means bigger deductions for your investments. Future updates may slowly adjust these limits for inflation, and bonus depreciation rules could also change. The main takeaway: if you plan to buy new equipment, acting sooner rather than later can maximize your tax savings, waiting too long could mean missing out if the rules shift.

Q: What is Section 179?

A: It allows businesses to deduct the full cost of qualifying property in the year it’s placed in service.

Q: Does HVAC equipment qualify?

A: Yes, HVAC systems, air conditioners, and heat pumps qualify.

Q: Can bonus depreciation be combined?

A: Yes, to cover costs above Section 179 limits.

Q: Are vehicles included?

A: Yes, SUVs and trucks may qualify, but SUVs have caps.

Q: What is the minimum business-use requirement?

A: Equipment must be used more than 50% for business purposes.

Q: Are there state differences?

A: Yes, some states do not follow federal rules exactly.

Q: What changed in 2025?

A: The One Big Beautiful Bill Act (OBBBA) doubled the Section 179 deduction limit to $2,500,000, raised the phase-out threshold to $4,000,000, restored 100% bonus depreciation, and expanded eligible property for contractors.

Q: Does this affect HVAC / plumbing / electrical businesses?

A: Yes, these businesses can now immediately expense more of their equipment, vehicles, and building improvements under 179, while combining with bonus depreciation for additional savings.

Q: Can I still deduct SUVs and passenger vehicles?

A: Yes, but SUVs are capped at $31,300 in 2025; heavy trucks/vans may fully qualify.

If you’re a small business owner, multi-family investor, or property owner, upgrading your HVAC system now may qualify for Section 179 tax benefits.

Call or text 479-502-9229 to speak with a comfort specialist and receive a system replacement quote.

This content is educational and does not constitute tax advice. Consult a tax professional for guidance.

Sources: Section179.org, irs.gov