Want to save with Paschal? Don’t miss our current offers and specials

Want to save with Paschal? Don’t miss our current offers and specials

Return to Paschal Resource & Education Hub

3If you live in Northwest Arkansas, and you are a customer of SWEPCO/AEP, Black Hills Energy, or Ozarks Electric, then you may qualify for a rebate on new energy efficient systems like an air conditioner or water heater. According to the Database of State Incentives for Renewables & Efficiency, utility customers in Arkansas currently qualify for up to 26 different incentives & rebate programs.

Arkansas produces large amounts of natural gas, which is the primary fuel used for energy production in the state, with coal and nuclear power following closely behind. In 1977, the Arkansas General Assembly passed the Energy Conservation Act, which authorized the Arkansas Public Service Commission (APSC) to promote energy efficiency and renewable energy resources. The vast majority of renewable energy is sourced from either biomass or hydroelectric power. Hydroelectric power supplies almost two-thirds of the state’s renewable energy sources with biomass making up close to the remaining third. Arkansas’ solar generating capacity is small but growing. In 2018, solar accounted for 0.3% of the state’s total energy generation or 3% of its renewable energy production.

If you’re interested in home geothermal, you’re probably wondering how you can save money with the 2021 federal geothermal tax credit.

The initial federal investment tax credit was part of the Energy Policy Act of 2005. This bill was passed to help solve energy problems and provide tax incentives for existing and new types of energy production, including wind and solar.

At the time, the credit only lasted through 2007, but it was so successful that it was extended several times. In 2008, the program was broadened to include geothermal heating and cooling systems.

In 2016, the tax credit did actually expire. However, it was reinstated in 2018 to include not just households with geothermal heat pumps installed in 2018, but it also retroactively included any geothermal heat pumps installed after January 1, 2017.

The federal tax credit initially allowed homeowners to claim 30 percent of the amount they spent on purchasing and installing a geothermal heat pump system from their federal income taxes. The tax credit currently stands at 26 percent throughout 2021 and 2022 before decreasing to 22 percent in 2023.

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. As long as your system is up and running by the end of 2022, you can claim the 26 percent from your federal income taxes.

There’s no limit to the value of the tax credit. As long as you are a homeowner of the house where the system is installed, you can claim the true percentage based on the year you installed the system.

Your geothermal heat pump has to meet Energy Star (a federal energy-efficiency program) requirements. This means the heat pump must meet or exceed specific efficiency standards.

If you’re considering either a new or replacement heating and cooling system in your home, SWEPCO will help pay for the installation of high efficiency heat pumps and air conditioning units. These high efficiency units can dramatically increase the comfort level in your home while lowering your SWEPCO bill.

SWEPCO will pay up to $2,000 for a qualifying unit and up to $2,500 per service address for heat pumps installed by a licensed HVAC company in NWA.

To get this rebate, you will need to have a SWEPCO approved HVAC company install the unit and submit the paperwork. Requirements:

A smart thermostat is a Wi-Fi enabled device that automatically adjusts the temperature settings in your home, helping you use less energy and save more money. It creates a home heating and cooling schedule that changes to energy-saving temperatures when you’re asleep or away.

Heating and cooling your home makes up about half of your SWEPCO bill. Smart thermostats help identify patterns in your energy usage, providing valuable insights that can lower your electric bill.

An Electric Vehicle (EV) Charging Station is the equipment needed to charge an EV, and these charging stations are available today at three different levels – Level 1, Level 2 and Level 3. Level 1 EV Charging Stations have the longest charging times while Level 3 Charging Stations have the fastest charging times.

Level 2 Charging Stations are in the middle with an average total charging time between four and six hours. They require a 208 or 240 volt wall outlet and provide 10 to 60 miles of range per hour of charging time. Individual charging times differ based on the type of EV charging station as well as the type of battery, how depleted it is and its energy capacity.

According to ENERGY STAR®, driving an EV and installing a Level 2 EV Charging Station at home provides savings, convenience and smart technology. For every mile driven, it costs half as much – on average – to drive an EV compared to a standard gasoline-powered vehicle. Some Level 2 EV Charging Stations offer remote power monitoring and control of the charging state of the connected vehicle. When installed at home, Level 2 EV Charging Stations enable an EV owner to leave the house every day at a full charge.

SWEPCO residential customers who own or rent a single-family home can install an ENERGY STAR-certified Level 2 EV Charging Station to qualify for a $250 rebate. Please note Level 2 EV Charging Station rebates have limited funding. Rebates are only available while funding lasts.

You can purchase an ENERGY STAR-certified Level 2 EV Charging Station online, from a local retailer or a dealership. Be sure to save your receipt since it’s part of your rebate application.

Once you’ve installed your Level 2 EV Charging Station, you’re ready to submit your rebate request.

Regardless of where you live, you may qualify for a federal tax credit of 30% of the cost of installing EV charging equipment. If you installed charging equipment after January 1, 2017, or if you install equipment before the end of this year, you are eligible to claim this credit, up to $1,000. Learn more at Plug in America.

To qualify for the BHEA Home Energy Savings Program the home must:

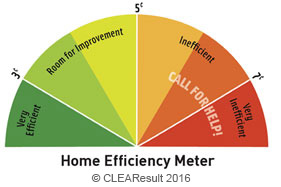

To determine whether you need an assessment, divide your highest winter Black Hills Energy bill by the square footage of your home. This will give you your energy cost per square foot. If your energy costs are 5 cents or more per square foot, your home qualifies for the Home Energy Savings Program.

$________ ÷ _________ = $/Sq. Ft.

(Bill Amt.) (Sq. Ft.)

You could qualify for a free air conditioner tune-up by utilizing a rebate with the CoolSaver program.

Typical improvement measures include:

An air conditioning system must be at least one year old to receive a CoolSaver Tune-Up. A/C units that have received a CoolSaver Tune-up in the past 5 years are ineligible.